Contents

Spider ETF meaning is an investment instrument being an exchange-traded fund that tracks an index known as Standard & Poor’s 500 indices (S&P 500). S&P 500 is an index that includes a basket of 500 large and mid-cap US companies that are listed on the New York Stock Exchange. State Street Global Advisors manage the exchange-traded fund, and each share of the ETF is a 10th of the S&P 500 index.

Where is the safest place to put your money in 2022?

Here are the best low-risk investments in November 2022:

Series I savings bonds. Short-term certificates of deposit. Money market funds. Treasury bills, notes, bonds and TIPS.

It also has a daily average of more than 2 million shares traded, making it an attractive and efficient asset in what can be a turbulent industry. An ETF is a mutual fund variant that follows a certain index, while very few of them are actively managed. ETFs are low-cost investments that enable one https://1investing.in/ to gain exposure to multiple stocks belonging to the same index simultaneously. Only on a stock exchange during trading hours the investor can buy or sell the ETF’s units. VTI seeks to track the performance of a benchmark index that measures the investment return of the overall US stock market.

The share price of COP on July 20 closed at $90.71, compared to the analyst consensus of $123.92 on a scale of one to five. The SPDR S&P Retail ETF, which tracks a broad group of retailers such as department and specialty stores, is up nearly 40 per cent this year. Defense stocks Raytheon Technologies, Lockheed Martin Corp, General Dynamics Corp, Northrop Grumman and L3Harris Technologies gained following news that Germany would increase its military spending.

The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others. Some of the investment instruments that investors use to diversify and cut down the risk factors are equities, derivatives and mutual funds. However, as mutual funds are an asset class that includes numerous investment instruments, a majority of the investors choose an investment avenue known as Exchange Traded Funds.

Fun with SPDR Sector ETFs

A recommendation rating of 1.7 indicates a strong buy, while a rating of 5 indicates a sell. As of one month ago, SPDR S&P Metals & Mining ETF returned 17.3%, while the Russell 1000 Index returned -3.5%. Metal prices have soared due to Russia’s invasion of Ukraine in February. Listed below are the three best-value, fastest-growing, and most-movement mining stocks. The increasing price of goods causes consumers to cut back on their purchases, which means that companies bring in less revenue.

- The finest ETF trading applications, such as those discussed on this page, are all regulated.

- US ETFs give you the benefit of diversifying in stocks to maintain a well-diversified portfolio, covering everything from technological growth to value stocks to large-caps to small-caps.

- An ETF that tracks the DBIQ Optimum Yield Diversified Commodity Index Excess Return includes futures contracts on 14 physically traded commodities.

- Only on a stock exchange during trading hours the investor can buy or sell the ETF’s units.

- As the world grappled with the coronavirus and sought viable remedies, 2020 was the year for growth-oriented healthcare brands.

- Yes, Indian investors can buy S&P 500 ETF Trust SPDR in the US stock market by opening an International Trading Account with Angel One.

ETFs are increasingly gaining widespread acceptance as investment vehicles, thanks to their low expense costs and simplicity. Independent financial strategist Nema Chhaya Buch also advocates for ETFs, especially for amateurs. “ETFs are low-cost investment options that are in line with market movements.

Publicly traded REITs can be bought and sold as stocks on major exchanges throughout the trading session. It’s common for these REITs to trade under significant volume, and they are considered quite liquid investments. Funds that focus on the one- to three-year area of the investment-grade corporate debt market are worth considering, says Lawrence Gillum, fixed-income strategist at LPL Financial. While those also have gotten hurt this year, losses are smaller because they focus on less-rate-sensitive maturities. Performance likely will improve as their managers replace maturing securities with new ones issued at lower prices and higher yields, experts says.

Nasdaq 100 ETF

Returns - The profits or income made by an ETF scheme or portfolio is known as returns. Gold Exchange Traded Funds are being traded in India since March 2007. Benchmark Asset Management Company Private Ltd. was the first to put in the proposal for gold ETF with the Securities and Exchange Great British Class Survey Board of India . This function allows users to replicate the trades of successful ETF investors. Keep an eye out for tools that pertain to education, research, and analysis as well. The finest ETF trading applications, such as those discussed on this page, are all regulated.

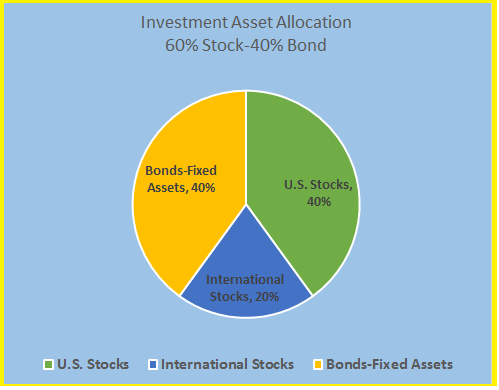

To start investing in US stocks, the exchange traded funds listed on the US stock exchanges can be a good starting point. Unlike buying individual stocks, you end up buying a bunch of stocks representing either an index or a specific sector. US ETFs give you the advantage of diversifying in international stocks and also keep you diversified across various leading themes in the US stock market. From technology growth to value-stocks to large-caps to small caps, the US ETFs are available to keep your portfolio well-diversified. For example, NIFTY 50 is a basket of the top 50 companies on the National Stock Exchange, chosen from different sectors of the economy.

Can I buy S&P 500 ETF Trust SPDR (SPY) shares?

An ETF’s tax-free wrapper make it an order of magnitude more attractive than an identical mutual fund. New issuers/managers have taken advantage of this and launched actively managed ETFs. Today, we review ETFs that were either clear winners or apparent losers in May.

However, make sure that you consult a financial advisor before investing. The investment seeks to provide investment results that correspond to the price and yield performance, of the Indxx Global Fintech Thematic Index. This may be an ideal ETF for diversifying the risks of stocks in a portfolio and a reliable long-term USD income stream. Investors looking to add bonds to their portfolio for risk reduction can utilize the BND ETF. The annual expense ratio is only 0.035%.

Then came Jack Bogle with his index fund and the ceaseless mantra of “costs and taxes matter” and the dynamic shifted, slowly at first and then suddenly, in favor of indexing. It was only a matter of time before people figured out the tax loophole of ETFs and now, there are over 2500 ETFs listed in the US. Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. Biotech firms’ research, clinical research, therapies, and remedies may be brought to the forefront by world health concerns like the coronavirus pandemic. Hope this blog has helped you learn quite a lot about some of the top Biotech ETFs. The bottom line is that, as both individual and institutional investors scramble to acquire shares of firms that may gain from specific product developments, the industry as a whole might experience a rise in stock prices.

World’s biggest ETF lures $9.8 billion in a day on vaccine hope

Exchange-traded funds invest in the same stocks as those in the index and the same proportion as their weight in the index. These exchange-traded funds can be based on indices tracking various asset classes like equity shares (e.g. NIFTY 50 ETF), bonds (e.g. 10-year G-Sec ETF), Gold (e.g. Gold ETF), Tri-party Repo (e.g. Liquid ETF), etc. Similar to the above indices that trade in India, SPDR ETFs are traded on the National Stock Exchange, mirroring the performance of their specific index. An exchange-traded fund is a collection of assets that you may purchase or sell on a stock market through a brokerage business. Biotech exchange-traded funds or Biotech ETFs allow you to make a single investment in a group of healthcare firms. These ETFs, similar to individual stocks, can be purchased and sold at any time during the day.

Besides, if you add transaction costs and taxes, we are not sure if it was worth the effort given the post-2011 market regime. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Furthermore, one other example of SPDRs is SPDR S&P Regional Banking ETFs.

The Trust holds the Portfolio and cash and is not actively "managed" by traditional methods. A believer of the Factor-based Investing approach and runs a Multi-Factor Portfolio that taps on the Value, Size, and Profitability Factors. Conducts the flagship Intelligent Investor Immersive program under Dr Wealth. An author of Secrets of Singapore Trading Gurus and Singapore Permanent Portfolio. Have been featured on various media such as MoneyFM 89.3, Kiss92, Straits Times and Lianhe Zaobao. Investors often look to these companies as they have strong fundamentals, good management teams and a sustainable competitive advantage.

Birla Sun Life Gold ETF

Dow Jones Industrial Average , also known as the Dow 30 is a price-weighted index of 30 large-cap US equities and differs slightly from some of the other top US indices as it solely includes US-based businesses. Its investments in foreign equity securities will be in both developed and emerging markets. Exchange-Traded Funds, better known as ETFs, are a type of investment funds that are traded on the stock exchanges.

Is SPDR the same as S&P 500?

Summary. The Standard and Poor Depositary Receipts (SPDR) S&P 500 ETF is an exchange-traded fund that tracks the S&P 500 stock market index. The SPDR S&P 500 ETF is listed on the New York Stock Exchange and trades under the ticker symbol SPY. The SPY's price tracks the S&P 500 index.

The US stock market crash of 2022 may be looked upon by many investors as an opportunity to create wealth over the long term. If picking individual stocks is not your cup of tea, a better way is to simply pick up an exchange-traded fund to invest in. One of the best reasons to invest in US stocks via ETFs is the ease of investing without having to worry about the right selection of stock. Buying individual stocks may be a tough nut to crack for most retail investors, and hence ETF investing is a better way forward. As opposed to purchasing individual stocks, you ultimately purchase a number of stocks that either reflects an index or a certain sector.

They became a crucial cog in world finance that can make or break entire economies. So powerful, in fact, that China blackmailed MSCI to include its domestic stocks in its Emerging Markets Index, which is tracked by close to $2 trillion in assets2. And India has been working on inclusion of Indian sovereign bonds in global bond indices3. For the longest time in the US, actively managed mutual funds ruled the roost.

ARKG, a $5 billion actively managed ETF, differs from the previous two funds in that it is meant to have 50 or fewer assets based on a unique set of internal parameters. In principle, this puts money behind the best possibilities – at least, according to the screening approach used by the biotech ETF's management, led by Cathie Wood, a well-known investor. While the market meltdown has brought down the valuations and the prices down, a further correction may not be ruled out.

Below are some of the best gold ETF products and their data to help you decide where to put your money in. The Russell 1000 Value Stock Index is down 4% from its June peak, though still up 13.2% this year. Yes, you can buy fractional shares of S&P Aerospace Defense SPDR ETF with Scripbox. Yes, you can buy fractional shares of S&P Biotech SPDR ETF with Scripbox. Today, on 19th Nov 2022, the price of S&P Biotech SPDR ETF Shares in India is $ 80.83. If you plan to wander away from the plain-vanilla stuff, please take the time to read the prospectus and understand how it works.